Interest Rate Calculator

Contents

- 1 Interest Rate Calculator

- 2 Interest Rate Calculator: Master Your Debt and Savings

- 2.1 What is an Interest Rate Calculator and Why Do You Need It?

- 2.2 How to Use an Interest Rate Calculator for Loans

- 2.3 Using an Interest Rate Calculator for Savings and Investments

- 2.4 Frequently Asked Questions

- 2.4.1 How does an interest rate calculator work?

- 2.4.2 What is the difference between simple and compound interest?

- 2.4.3 Can an interest rate calculator help me with my mortgage?

- 2.4.4 Is an online interest calculator accurate?

- 2.4.5 How can I lower the total interest I pay on a loan?

- 2.4.6 What is APR, and how does it affect my loan?

- 2.4.7 How can I find the best interest rate on a loan?

- 2.5 Conclusion

Interest Rate Calculator

Interest Rate Calculator

Support This Project ❤️

If you find this tool helpful, consider making a small donation to support its development.

Account Holder: Majid Farooq

Bank Name: Habib Bank Limited

IBAN: PK40HABB0001947100292703

Country: Pakistan

Interest Rate Calculator: Master Your Debt and Savings

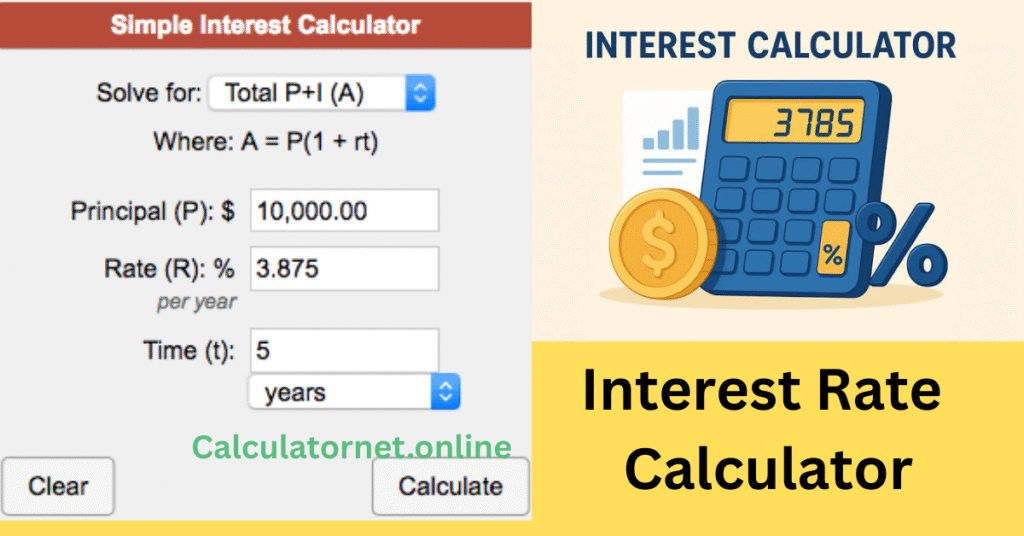

Navigating the world of loans, credit cards, and investments can feel like a maze, with a complex tangle of percentages and repayment schedules. It's easy to get lost and feel like you're not in control of your financial future. Whether you're considering a new car loan, planning to pay off a mortgage, or trying to understand how your savings will grow, a simple tool can make all the difference. That tool is an interest rate calculator. This guide will show you how this powerful tool works and why it's essential for anyone looking to make smarter financial decisions.

What is an Interest Rate Calculator and Why Do You Need It?

An interest rate calculator is a digital tool that helps you compute the interest on a loan or a savings account. By inputting key variables like the principal amount, the interest rate, and the loan term, you get a clear picture of what you will pay or earn over time. Think of it as your personal financial crystal ball.

So, why is this so important?

- Financial Clarity: It demystifies how interest works, turning complex formulas into simple, easy-to-understand numbers.

- Budgeting: Knowing your exact monthly payments helps you budget effectively and avoid surprises.

- Negotiating Power: When you understand the numbers, you're in a better position to negotiate with lenders for better terms.

- Comparing Options: It allows you to quickly compare different loan or savings products to find the one that best suits your goals.

How to Use an Interest Rate Calculator for Loans

Using an interest rate calculator for a loan is straightforward. Here’s a breakdown of the key variables you'll need:

- Principal Amount: The initial sum of money you borrow.

- Interest Rate: The percentage charged by the lender on the principal. This is often an annual percentage rate (APR).

- Loan Term: The duration over which you plan to repay the loan, typically in months or years.

When you enter these details, the calculator will instantly show you your estimated monthly payment and the total interest you’ll pay over the life of the loan. This is crucial for understanding the true cost of borrowing. For example, a lower monthly payment might seem great, but a longer loan term could mean paying thousands more in interest.

Real-World Example: Car Loan Comparison

Let’s say you are buying a car and comparing two loan offers. Here's how a calculator can help:

| Feature | Loan A | Loan B |

| Principal | $20,000 | $20,000 |

| Interest Rate | 6% | 7% |

| Term | 60 months | 48 months |

| Monthly Payment | $386.66 | $480.01 |

| Total Interest Paid | $3,199.68 | $3,040.38 |

As you can see, even with a higher interest rate, Loan B's shorter term results in a lower overall cost. This simple comparison highlights how using an interest rate calculator can prevent you from making a costly mistake.

Using an Interest Rate Calculator for Savings and Investments

Interest doesn't just work against you—it can also work for you! An interest rate calculator is also a fantastic tool for projecting the growth of your savings or investments. By plugging in your initial deposit, the interest rate, and how often you plan to add to it, you can see how your money compounds over time. This is especially useful for planning for retirement, a down payment on a home, or other long-term financial goals.

The concept of compound interest is a powerful one. It's the interest you earn on your principal and on the accumulated interest from previous periods. Over time, this can lead to significant wealth accumulation.

Frequently Asked Questions

How does an interest rate calculator work?

An interest rate calculator uses a financial formula to compute future values based on a set of variables, including the principal, interest rate, and loan term. It automates the complex math to give you a clear, instant result.

What is the difference between simple and compound interest?

Simple interest is calculated only on the principal amount, while compound interest is calculated on both the principal and the accumulated interest from previous periods. Compound interest leads to faster growth in savings and a higher total cost for a loan.

Can an interest rate calculator help me with my mortgage?

Yes, absolutely. A mortgage interest calculator is a specialized tool that helps you estimate your monthly mortgage payments, see how much of each payment goes toward the principal versus interest, and understand the total cost of your home loan over its full term.

Is an online interest calculator accurate?

Most reputable online interest rate calculators are very accurate. They use standard financial formulas. Just be sure to use a trusted source, such as a financial institution or a well-regarded finance blog.

How can I lower the total interest I pay on a loan?

To lower the total interest on a loan, you can either:

- Pay off the loan faster by making extra payments.

- Refinance your loan to a lower interest rate.

- Choose a shorter loan term, even if the monthly payment is higher.

What is APR, and how does it affect my loan?

APR, or Annual Percentage Rate, is the total cost of a loan over a year, including interest and other fees. A lower APR means a lower overall cost of borrowing. It's the most reliable figure to use when comparing loan products.

How can I find the best interest rate on a loan?

Shop around and compare offers from multiple lenders, including banks, credit unions, and online lenders. Check your credit score and take steps to improve it, as a better score can help you qualify for lower rates.

Conclusion

Understanding your financial obligations and opportunities is the first step toward achieving your goals. Whether you’re a student planning for a car, a homeowner considering a refinance, or an investor saving for retirement, an interest rate calculator is an indispensable tool. It takes the guesswork out of finance, giving you the clarity and confidence to make informed decisions.

By using this powerful tool, you can not only avoid costly mistakes but also actively plan for a more secure financial future. Take control of your money today by making a simple calculation.

What financial goal are you working toward? Share in the comments below!