payment Calculator

Payment Calculator

Loan Details

Results Summary

Monthly Payment

$0.00

Total Principal Paid

$0.00

Total Interest Paid

$0.00

Total Cost of Loan

$0.00

Donation Details

Name: Majid Farooq

Bank Name: Habib Bank Limited

Account Number/IBAN: PK40HABB0001947100292703

Country: Pakistan

Payment Calculator: Master Your Loan Payments

Unlock the power of a payment calculator to forecast your loan terms and payments. Learn to budget for mortgages, auto loans, and more with confidence.

Taking on a loan, whether for a new car, a home, or a personal expense, can be a major financial decision. It’s exciting to think about what you’ll get, but a big question usually looms: “What will my monthly payments be?” Without a clear answer, it’s easy to feel lost and anxious. Fortunately, a payment calculator can be your most powerful tool in navigating this financial journey. It helps you understand exactly what you’re signing up for and gives you the confidence to manage your debt effectively. This guide will walk you through how to use this essential tool, explain the key terms, and show you how to take control of your loan.

What Does a Loan Payment Calculator Do?

A loan payment calculator is a straightforward tool that helps you figure out the details of a loan. By inputting just a few numbers, you can instantly see a clear picture of your future payments. It primarily works in two ways:

- Fixed Term: This is the most common use. You tell the calculator the loan amount, the interest rate, and how long you want to pay it back (the term). It then calculates your fixed monthly payment. This is perfect for planning a mortgage or a car loan.

- Fixed Payments: This method is a great way to figure out how fast you can pay off a debt. You input the loan amount, the interest rate, and how much you can afford to pay each month. The calculator then tells you exactly how many months (or years) it will take to become debt-free.

Both options help you create a clear roadmap for your financial future.

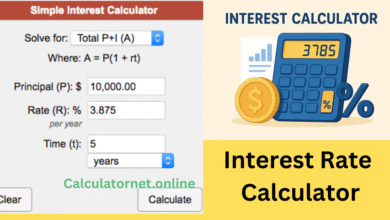

Understanding the Key Factors: Interest Rate and APR

When you’re dealing with loans, you’ll see the terms interest rate and APR (Annual Percentage Rate) used a lot. While they sound similar, they are not the same thing.

- Interest Rate: This is simply the cost of borrowing the principal amount of money. It’s what you pay the lender for the privilege of using their money.

- APR: This is a broader measure of the total cost of a loan. It includes the interest rate, plus other fees and charges like broker fees, closing costs, and administrative fees. When you’re comparing loan offers, the APR gives you a more accurate picture of the total cost.

For a true sense of what you’ll pay, it’s always best to use the APR in your payment calculator. This ensures you account for all potential costs, not just the interest.

Fixed vs. Variable Rates: Which Is Right for You?

Another important consideration is whether you choose a fixed or variable interest rate. The type of rate you pick will directly affect how a payment calculator works for you.

- Fixed-Rate Loans: The interest rate stays the same for the entire life of the loan. This is common for mortgages and auto loans. Your monthly payment remains predictable, making it easy to budget.

- Variable-Rate Loans: The interest rate can change over time, typically based on a market index. This can mean lower initial payments, but they could rise significantly if the market changes. It’s a riskier option but can be beneficial if interest rates are trending down.

While a payment calculator can easily handle fixed-rate calculations, variable-rate loans are harder to predict. You can still use the calculator to see what your payment would be at different potential interest rates to understand your risk.

Practical Ways to Use a Payment Calculator

Beyond figuring out your monthly payment, a payment calculator can be a strategic financial tool.

- Compare Loan Offers: Have a few different loan offers? Plug each one into the calculator to see which one provides the best terms for your budget. You can compare different interest rates and loan terms side-by-side.

- Decide on a Loan Term: Should you take a 15-year or a 30-year mortgage? Use the calculator to see the difference in monthly payments and the total amount of interest you’ll pay over the life of the loan. A shorter term often means less interest paid overall, even if the monthly payment is higher.

- Plan for Early Payoff: If you want to pay off your debt faster, use the “Fixed Payments” tab. Enter the amount you can pay above your minimum payment to see how much sooner you can become debt-free.

Frequently Asked Questions

Q1: How do you calculate loan payments?

You can calculate loan payments by using a payment calculator. Simply input the total loan amount, the loan term (in years or months), and the interest rate. The calculator uses a specific formula to determine the fixed monthly payment required to pay off the loan and all accrued interest within the given time frame.

Q2: How does a payment calculator help me with a mortgage?

A payment calculator is crucial for mortgages. It allows you to see how different loan amounts, interest rates, and loan terms (like 15 vs. 30 years) impact your monthly payment. This helps you determine a comfortable budget, compare different lender offers, and understand the long-term cost of your home loan.

Q3: Does a payment calculator include taxes and fees?

Most standard payment calculators only calculate the principal and interest portion of your loan. For a more accurate picture of your total monthly housing cost, you’ll need to manually add in other expenses like property taxes, homeowners insurance, and HOA fees.

Q4: Can I use this calculator for a car loan?

Yes, you can. A payment calculator is excellent for car loans. You can input the total amount you want to finance, the interest rate you’ve been offered, and the loan term (e.g., 60 or 72 months). This helps you decide which car is affordable and whether a longer or shorter term is right for you.

Q5: What’s the difference between a loan calculator and a payment calculator?

The terms are often used interchangeably. A “loan calculator” is a broad term that can include features like a payment calculator, an amortization schedule, or a tool to compare different loan options. A “payment calculator” is a specific function within a loan calculator.

Q6: How can I lower my monthly loan payment?

You can lower your monthly payment by either taking out a smaller loan amount, choosing a longer loan term, or securing a lower interest rate. A payment calculator can help you model each of these scenarios to see how they impact your monthly financial commitment.

Q7: Is it better to have a fixed or variable interest rate?

It depends on your financial situation and risk tolerance. A fixed-rate loan offers predictability and stability, making it easier to budget. A variable-rate loan may offer a lower starting rate but comes with the risk that your payments could increase in the future.

Conclusion

A payment calculator is more than just a tool; it’s a financial planning partner. It empowers you to take control of your loan decisions, whether you’re buying a car, a home, or simply looking to pay off debt. By understanding the key variables and using the calculator to run different scenarios, you can make informed choices that lead to a more secure and predictable financial future. Don’t leave your loan payments to chance—use a calculator to find the path that works best for you.

Have you ever used a payment calculator? Share your experience or any tips you have in the comments below!