Salary Calculator

Salary Calculator

Colorful Salary Calculator

Inputs

Results

Hourly

—

Daily

—

Weekly

—

Biweekly

—

Monthly (Gross/Net)

—

Annual (Gross/Net)

—

Donate

If this tool helps you, consider supporting the developer. Your contribution keeps it free and improving! 💛

Name: Majid Farooq

Bank: habib bank limited

Account/IBAN: PK40HABB0001947100292703

Country: Pakistan

Salary Calculator: Understand Your True Earnings

A salary calculator is a powerful tool that helps you see the complete picture of your compensation, not just your base pay. Ever wonder how your hourly wage translates to an annual salary, or what your true take-home pay looks like after accounting for taxes and benefits? This article will walk you through the factors that influence your income and how a salary calculator can help you make sense of it all. Whether you’re a recent graduate negotiating your first offer, a seasoned professional considering a job change, or a freelancer setting your rates, understanding these calculations is crucial for your financial well-being. By the end, you’ll be able to use a salary calculator to project your earnings and make informed career decisions.

What’s the Difference Between a Salary and a Wage?

While often used interchangeably, the terms salary and wage have distinct meanings. A salary is typically a fixed annual amount paid to an employee on a regular basis, such as monthly or bi-weekly. This amount usually doesn’t fluctuate based on the hours worked. Salaried employees are often considered “exempt” under the Fair Labor Standards Act (FLSA), meaning they are not eligible for overtime pay.

A wage, on the other hand, is a payment based on the number of hours worked, multiplied by an hourly rate. Wage-earners are usually “non-exempt” and are entitled to overtime pay, typically at 1.5 times their regular rate for hours worked over 40 in a week. Generally, wage earners tend to earn less than salaried employees, but their overtime can sometimes result in higher earnings.

Key Factors that Influence Your Salary

Many variables affect how much you earn. According to the U.S. Bureau of Labor Statistics in 2024, the average salary for a full-time employee was about $60,580 per year. However, this number can change dramatically depending on a number of factors:

- Age and Experience: Earnings tend to increase with age and experience, peaking between ages 40 and 65. For example, men aged 55 to 64 earned an average of $77,480 annually, while women in the 45 to 54 age bracket earned the most, at an average of $60,632.

- Education Level: Higher education generally leads to higher earnings. Workers with at least a bachelor’s degree earned an average of $88,244 annually, whereas those without a high school diploma earned a median of $38,168.

- Race and Gender: Racial and gender pay gaps continue to exist. In 2024, Black men earned a median salary of $51,324 compared to white men at $67,184. The gap was smaller for women, with Black women earning $48,620 compared to white women at $55,588.

- Industry and Location: Your field of work and where you live play a huge role. An office clerk in a large city may earn significantly more than one in a small town. The cost of living is also a critical consideration when comparing salaries in different locations.

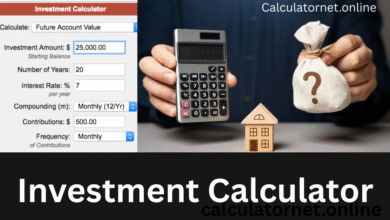

Employee Benefits: More Than Just a Paycheck

Your total compensation isn’t just your salary. Many additional benefits add significant value to your overall earnings. These can include:

- Employer-provided healthcare insurance

- Contributions to retirement plans (like a 401k)

- Paid time off (PTO) for holidays, sick days, and vacation

- Bonuses and company discounts

Freelancers and contractors, while often earning higher hourly rates, typically lack these benefits. When comparing a salaried position to a contract role, it’s crucial to factor in the monetary value of these benefits to get an accurate comparison of your total compensation.

Understanding the Adjusted Salary Calculation

A salary calculator often provides both an “unadjusted” and an “adjusted” salary figure. The unadjusted amount is your gross pay without considering holidays or vacation time. The adjusted amount, however, accounts for these non-working days.

Here’s how a typical calculation works:

- Unadjusted Annual Salary: Multiply your hourly rate by the number of hours per day and the number of working days per year (e.g., $30/hour × 8 hours/day × 260 days/year = $62,400).

- Adjusted Annual Salary: Subtract your paid holidays and vacation days from the total working days before calculating. For example, with 10 holidays and 15 vacation days, the calculation would be: $30/hour × 8 hours/day × (260 – 25) days/year = $56,400.

Using a salary calculator can help you visualize these differences and understand your true earning potential, especially when you’re comparing offers with different benefits packages.

How to Increase Your Salary

Want to earn more? There are several proven strategies you can use to boost your income:

- Further Your Education: Whether it’s a higher degree or professional certifications, gaining new qualifications can significantly increase your earning potential.

- Build Experience and Skills: The more experience you have and the more valuable your skills become, the more leverage you’ll have for negotiating a higher salary.

- Network: Connect with professionals in your industry through organizations and conferences. Networking can open doors to new, higher-paying opportunities.

- Negotiate: Don’t be afraid to ask for more. Highlight your accomplishments and the value you bring to the company during performance reviews or when accepting a new job offer.

- Change Jobs: It’s a common strategy for a salary increase. Moving to a new company often results in a 10% or more jump in pay, as you can leverage your skills and experience to negotiate a higher starting point.

Frequently Asked Questions

What is a salary calculator?

A salary calculator is an online tool that converts salary amounts between different pay frequencies, such as hourly, weekly, bi-weekly, or annually. It helps you understand how much you earn and how your pay is affected by factors like holidays and vacation days. It can be a great way to budget and plan your finances.

What is the average salary in the US?

According to the U.S. Bureau of Labor Statistics, the average full-time employee salary was about $1,165 per week, or $60,580 per year, in the third quarter of 2024. This number is an average and can vary widely based on your industry, location, education, and years of experience.

What is the difference between bi-weekly and semi-monthly pay?

Bi-weekly pay means you are paid once every two weeks, resulting in 26 paychecks a year. Semi-monthly pay means you are paid twice a month, usually on the 15th and the last day of the month, which results in 24 paychecks a year.

Does my employer have to pay me for holidays?

In the U.S., the Fair Labor Standards Act (FLSA) does not require private employers to offer paid holidays. However, many companies do so to remain competitive and attract employees. If you work for the federal government, you will benefit from all 11 federal holidays.

Why is there a gender pay gap?

The gender pay gap—the difference between the average earnings of men and women—is influenced by many complex factors. These can include career choices and industry segregation, motherhood and time out of the workforce, and, in some cases, outright discrimination.

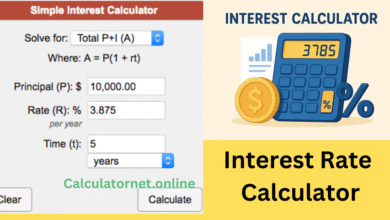

How do you calculate your hourly wage from a salary?

To convert your annual salary to an hourly wage, you typically divide your annual salary by the number of hours worked per year. Assuming a 40-hour workweek and 52 weeks a year, the calculation would be: (Annual Salary) / (40 hours/week x 52 weeks/year) = (Annual Salary) / 2080.

How can I make more money?

There are a number of strategies to increase your income, including pursuing further education or certifications, gaining more experience in your field, networking to find new opportunities, negotiating for a higher salary in your current role, and, if necessary, changing jobs. All of these can help you grow your earnings over time.

Conclusion

Understanding your salary and all the factors that influence it is essential for managing your personal finances and advancing your career. By using a salary calculator and keeping these key statistics in mind, you can get a clearer picture of your total compensation and make smarter decisions about your career path.

What other financial tools do you find most helpful? Share your thoughts and experiences in the comments below!