Mortgage Calculator

Contents

- 1 Mortgage Calculator

- 2 Mortgage Calculator: Plan Your Home Purchase with Confidence

- 2.1 Introduction

- 2.2 What Is a Mortgage Calculator?

- 2.3 Key Components of a Mortgage Calculator

- 2.4 Sample Mortgage Calculation

- 2.5 Amortization Schedule Explained

- 2.6 Strategies to Save on Your Mortgage

- 2.7 A Brief History of U.S. Mortgages

- 2.8 FAQ: Common Mortgage Calculator Questions

- 2.8.1 1. How accurate is a mortgage calculator?

- 2.8.2 2. Can I include extra payments in a mortgage calculator?

- 2.8.3 3. What’s the difference between APR and interest rate?

- 2.8.4 4. How does a down payment affect my mortgage?

- 2.8.5 5. Why do I need PMI?

- 2.8.6 6. Can I pay off my mortgage early?

- 2.8.7 7. How do property taxes impact my mortgage?

- 2.9 Conclusion

Mortgage Calculator

Calculate your monthly payments and view your amortization schedule.

Loan Details

Results

Monthly Payment

$0.00

Total Interest

$0.00

Total Payment

$0.00

Amortization Schedule

| # | Date | Payment | Principal | Interest | Balance |

|---|

Mortgage Calculator: Plan Your Home Purchase with Confidence

Use a mortgage calculator to estimate monthly payments, interest, and total costs. Learn how to plan your home purchase with our expert guide!

Introduction

Buying a home is one of life’s biggest financial decisions, and a mortgage calculator can be your best tool to plan it wisely. Whether you’re eyeing a $400,000 home or exploring loan options, understanding your monthly payments, interest rates, and additional costs like property taxes is crucial. This guide will walk you through how a mortgage calculator works, its key components, and strategies to save on your mortgage. By the end, you’ll feel confident navigating your home purchase and avoiding financial surprises.

What Is a Mortgage Calculator?

A mortgage calculator is an online tool that estimates your monthly mortgage payments based on inputs like home price, down payment, loan term, and interest rate. It also factors in recurring costs like property taxes, home insurance, and HOA fees. Designed primarily for U.S. residents, it helps you understand the full financial picture of homeownership.

Why Use a Mortgage Calculator?

- Budget Planning: See how much you’ll pay monthly, including taxes and insurance.

- Compare Loan Options: Test different loan terms (e.g., 15 vs. 30 years) to find the best fit.

- Understand Interest Costs: Learn how much of your payment goes toward interest versus principal.

- Explore Extra Payments: See how extra payments can shorten your loan term and save on interest.

Key Components of a Mortgage Calculator

A mortgage calculator breaks down the essential elements of a home loan. Here’s what you need to know:

Loan Amount

This is the home price minus your down payment. For example, a $400,000 home with a 20% down payment ($80,000) results in a $320,000 loan. Your household income and affordability often determine the maximum loan amount. For a detailed estimate, try a House Affordability Calculator (opens in new tab, rel=”nofollow”).

Down Payment

The upfront payment, typically 20% of the home price, though some loans allow as low as 3%. A larger down payment often secures better interest rates and may eliminate the need for private mortgage insurance (PMI).

Loan Term

The time to repay the loan, usually 15, 20, or 30 years. Shorter terms (e.g., 15 years at 5.43%) have lower interest rates but higher monthly payments compared to longer terms (e.g., 30 years at 6.455%).

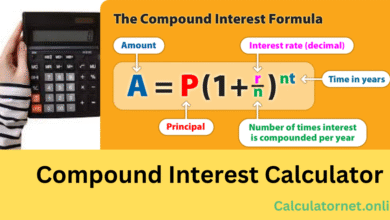

Interest Rate

The cost of borrowing, expressed as an Annual Percentage Rate (APR). Fixed-rate mortgages (FRM) maintain the same rate, while adjustable-rate mortgages (ARM) fluctuate after an initial period. For example, a 6% APR means 0.5% monthly interest.

Recurring Costs

These include:

- Property Taxes: Typically 1.1% of the home’s value annually (e.g., $4,800 for a $400,000 home).

- Home Insurance: Averages $1,500/year, depending on location and coverage.

- PMI: Required if your down payment is less than 20%, costing 0.3%–1.9% of the loan annually.

- HOA Fees: Common in condos or planned communities, usually under 1% of the home’s value.

- Other Costs: Maintenance and utilities, often 1% or more of the home’s value yearly.

Sample Mortgage Calculation

Let’s break down a sample calculation for a $400,000 home:

| Feature | Details |

|---|---|

| Home Price | $400,000 |

| Down Payment | $80,000 (20%) |

| Loan Amount | $320,000 |

| Loan Term | 30 years |

| Interest Rate | 6.455% |

| Monthly Payment | $2,013.16 |

| Property Taxes | $400/month (1.2%) |

| Home Insurance | $125/month |

| Other Costs | $333.33/month |

| Total Monthly Cost | $2,871.49 |

Total Out-of-Pocket Over 30 Years: $1,033,736.45, including $404,736.45 in interest.

Amortization Schedule Explained

An amortization schedule shows how your payments reduce the loan balance over time. For the above example, here’s a snapshot:

| Year | Interest | Principal | Ending Balance |

|---|---|---|---|

| 1 (8/25-7/26) | $20,551 | $3,607 | $316,393 |

| 5 (8/29-7/30) | $19,491 | $4,667 | $299,400 |

| 10 (8/34-7/35) | $17,719 | $6,439 | $270,977 |

| 15 (8/39-7/40) | $15,274 | $8,884 | $231,761 |

| 30 (8/54-7/55) | $824 | $23,334 | $0 |

Early payments mostly cover interest, but over time, more goes toward the principal, reducing the balance faster.

Strategies to Save on Your Mortgage

Paying off your mortgage early can save thousands in interest. Here are three proven strategies:

- Make Extra Payments: Even small additional payments reduce the principal, lowering total interest. For example, paying an extra $100/month could shave years off your loan.

- Biweekly Payments: Paying half your monthly payment every two weeks results in 13 full payments per year, speeding up repayment.

- Refinance to a Shorter Term: Switching to a 15-year loan (e.g., 5.43%) reduces interest but increases monthly payments. Check closing costs before refinancing.

Pros and Cons of Early Repayment

| Aspect | Pros | Cons |

|---|---|---|

| Interest Savings | Reduces total interest paid | May face prepayment penalties |

| Faster Payoff | Own your home sooner | Higher monthly payments (refinancing) |

| Emotional Freedom | Debt-free lifestyle | Locks capital in the home |

| Tax Implications | None | Loss of mortgage interest deduction |

A Brief History of U.S. Mortgages

In the early 20th century, homeownership required a 50% down payment and short-term loans, making it unaffordable for many. The Great Depression led to widespread foreclosures, prompting the creation of the FHA and Fannie Mae in the 1930s. These entities introduced 30-year mortgages with lower down payments, fueling a post-WWII housing boom. By 2001, homeownership hit 68.1%. During the 2008 financial crisis, federal interventions stabilized the market, and today, the FHA and Fannie Mae continue to support affordable homeownership.

FAQ: Common Mortgage Calculator Questions

1. How accurate is a mortgage calculator?

Mortgage calculators provide estimates based on your inputs. Actual costs may vary due to lender fees, credit scores, or changing rates. Always consult a lender for precise figures.

2. Can I include extra payments in a mortgage calculator?

Yes, most calculators allow you to input extra monthly, annual, or one-time payments to see their impact on the loan term and interest savings.

3. What’s the difference between APR and interest rate?

The interest rate is the cost of borrowing, while APR includes additional fees, giving a fuller picture of the loan’s cost. For example, a 6% APR includes both interest and fees.

4. How does a down payment affect my mortgage?

A larger down payment reduces the loan amount, lowers monthly payments, and may eliminate PMI, saving money over time.

5. Why do I need PMI?

PMI protects lenders if you default and your down payment is less than 20%. It’s typically required until your loan-to-value ratio reaches 80%.

6. Can I pay off my mortgage early?

Yes, through extra payments, biweekly payments, or refinancing. Check for prepayment penalties in your loan agreement.

7. How do property taxes impact my mortgage?

Property taxes increase your monthly payment. In the U.S., they average 1.1% of the home’s value annually and are often paid through an escrow account.

Conclusion

A mortgage calculator is an essential tool for planning your home purchase, helping you estimate monthly payments, interest, and additional costs like property taxes and insurance. By understanding loan components and exploring early repayment strategies, you can save thousands and achieve homeownership faster. Use our guide to make informed decisions and take control of your financial future. Have questions or tips to share? Leave a comment below or explore more home-buying resources!